Planning for the real cost of education in Australia

Last updated: 06 February 2025 | Estimated read time: 5 Minutes

The rising cost of education in Australia is a worry for many parents. Understanding the costs involved early could help you better plan for the future.

Investing in your child's education is a big expense, but one that’s important to many families. Being aware of and planning for growing education expenses and uni fees could help you to put a financial plan in place to help fund the education you want for you children.

When it comes to school fees in Australia, the location of your residence is a major factor. The cost of schooling also tends to be higher for those parents who enrol their kids in private schools.

Here’s an overview of some things to consider when working out how much to put aside in your savings plan.

What is the cost of education in Australia?

Data from the annual national Futurity Cost of Education survey conducted by McCrindle1 shows the total estimated cost of education for a child starting school in Australia in 2025.

Education costs on Australian households

25% of Australian parents find paying for the children’s school fees or voluntary contributions is having a significant or moderate impact on their households.

A further 26% believe it is having a slightly negative impact.

Financial readiness for education

Only 34% of Aussie parents feel they are financially equipped to contribute to lifelong education for their children–

with 12% not feeling equipped at all.

Total estimated cost of education for a child starting school in 2025

| Location | Government | Catholic | Independent |

| Major Cities | $123,294 | $193,666 | $350,158 |

| Regional/Remote areas | $81,141 | $153,144 | $244,075 |

*These numbers are population-weighted and projected over a 13-year period and provided as a guide only. The actual costs cannot be guaranteed.

Source: 1 Futurity Investment Group:The Cost of Education in Australia 2025.

A look to the states and territories

| Location | Government | Catholic | Independent |

| Most expensive location | NSW metro | Canberra | NSW metro |

| Average 13-year cost | $150,323 | $215,633 | $411,108 |

| Location | Government | Catholic | Independent |

| Most affordable location | Brisbane | SA metro | WA metro |

| Average 13-year cost | $101,064 | $185,548 | $300,109 |

*These numbers are population-weighted and projected over a 13-year period and provided as a guide only. The actual costs cannot be guaranteed.

Source: 1 Futurity Investment Group:The Cost of Education in Australia 2025.

Factors that affect the cost of schooling in Australia

The cost of education is influenced by whether the child is being enrolled in a public or private school, the state that you live in and whether you live in a metro area or are regionally based; as the cost of schooling in cities is usually more expensive than regional or remote areas.

The cost of education is just one aspect to consider when deciding between public school vs private school. Other considerations include the curriculum, extracurricular activities, teaching quality, and the overall environment.

Even after enrolling in a school, there are other costs to consider. Tuition fees, textbooks, uniforms, and various other educational expenses can add up. So preparing for these financial obligations could help you stay on top of your finances.

How much are public school fees in Australia?

Public school fees vary from state to state and while public education in Australia is generally funded by the government and many public schools don’t charge mandatory fees, parents are often expected to pay a voluntary financial contribution instead.

Primary school tuition fees

Parents sending their child to a public school can expect to pay an average of around $221 annually for primary school tuition fees. This could climb as high as $6,541 for an independent school2.

Here's the national annual average of tuition fees by school type and stage in 2023 according to data from the Futurity Investment Group: Cost of education index2:

National Annual Average of Tuition Fees by School Type & Stage in 2023*

| Government Schools | Catholic Schools | Independent Schools | |

| Primary | $221 | $2,132 | $6,541 |

| Secondary | $536 | $5,477 | $11,553 |

Source: Futurity Investment Group: Cost of education index2

How much are ancillary costs of education in Australia?

There are other school-related expenses that may be charged in addition to the cost of tuition and need to be considered when choosing a school.

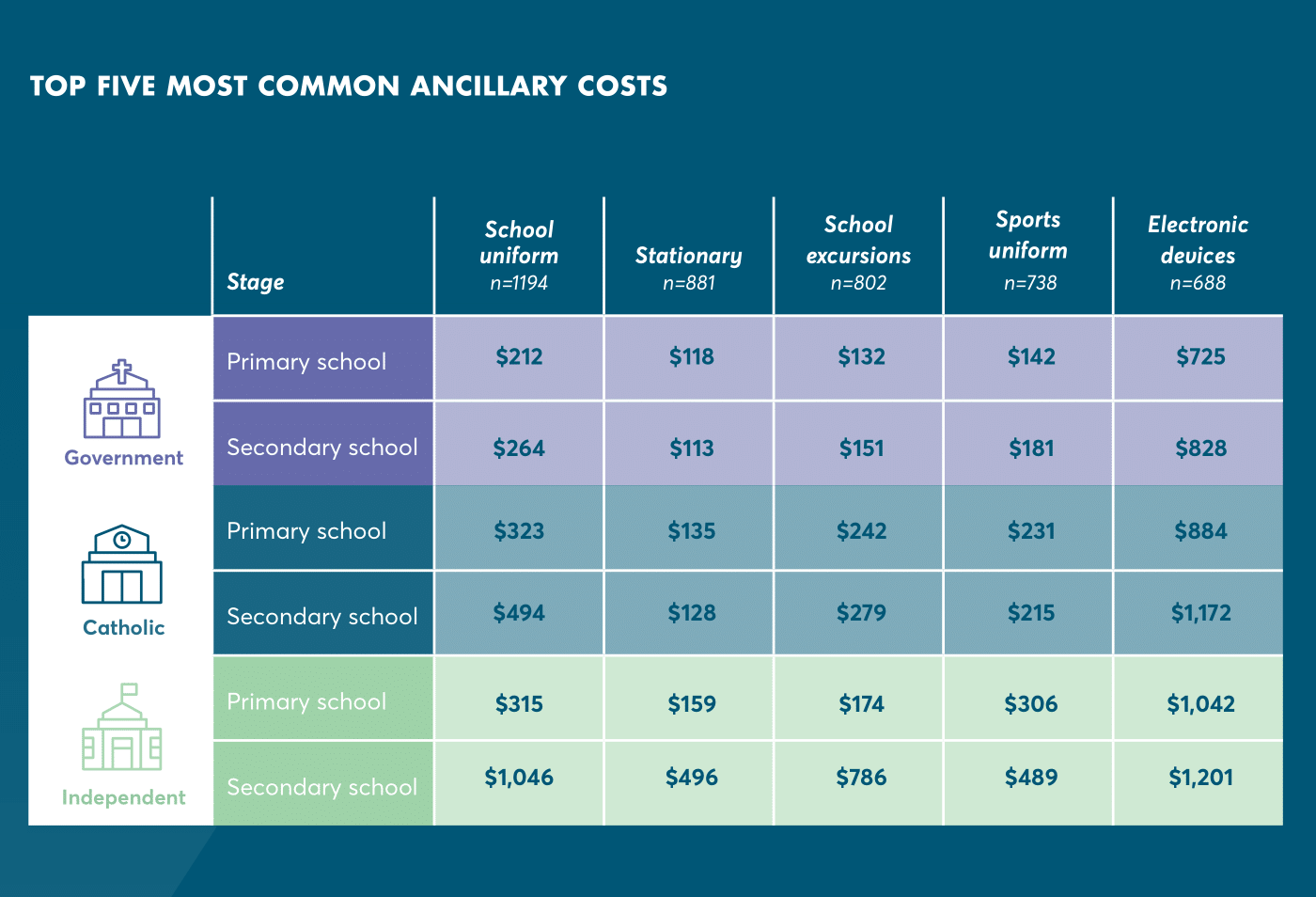

These expenses could include school uniforms, stationery or school supplies, school excursions, sports uniforms, and electronic devices.

Then there are the basic stationery items (pens, paper, textbooks), which may change and become more specialised as the child moves through their stage of education (scientific calculators or art supplies for example).

Here's the national annual average of ancillary costs according to data from the Futurity Investment Group: Cost of education index2.

How much does university cost in Australia?

As more and more students choose to attend university to help them stand out in today's competitive world, understanding the average cost of university in Australia can help you understand the financial implications involved and help you to make an informed decision.

Uni fees vary depending on several factors such as which University they attend, their chosen course and the number of units they need to complete.

Tuition fees for undergraduate programs typically range from $20,000 to $45,000 per year. For post-grad courses, the fees can be higher, averaging between $22,000 and $50,000 annually. PhD programs may have lower tuition fees due to government subsidies, and typically range from $18,000 to $42,000 per year3.

On top of tuition fees, there are other costs to consider when pursuing higher education. Living expenses, textbooks, accommodation, transportation, and social activities are some of the additional expenses that need to be factored into any budgeting decisions.

To support students in managing these costs, various scholarships, grants, and student loans could be available.

Helpful planning resources

Because the cost of education is pretty significant, it’s important to plan your budget carefully. Below are some useful links when you are planning for your children’s education:

- The Futurity Investment Cost of Education calculator

- The Australian Government’s StudyAssist FEE-HELP

- The Australian Government’s StudyAssist HECS-HELP

We're here to help

If you need to pay for education costs but don't quite have the required savings, a personal loan could be an option worth exploring. Whatever you decide, it’s a smart idea to get professional advice before taking out a loan.

To get you started, find out what your individual rate and repayments might be before applying. What’s more, it won't affect your credit score.

Got a question? Contact us on 1300 108 794. We're here to help.

Sign up to our newsletter

If you like this article, you'll love our monthly Real Lives newsletter.

Personal information is collected, used, stored and disclosed in accordance with Privacy Policy. You can opt out of this newsletter at any time by using the unsubscribe link provided at the bottom of each email.

Financial Support

Calling from overseas? +61 2 7227 1517

Information provided is factual information only and is not intended to imply any recommendation about any financial product(s) or constitute tax advice. If you require financial or tax advice you should consult a licensed financial or tax adviser.

All applications for credit are subject to credit assessment, eligibility criteria and lending limits. Terms, conditions, fees and charges apply.

The results of the borrowing power calculator are based on information you have provided and is to be used as a guide only. The output of the calculator is subject to the assumptions provided in the calculator (see 'about this calculator') and are subject to change. It does not constitute a quote, pre-qualification, approval for credit or an offer for credit and you should not enter commitments based on it. The interest rates do not reflect true interest rates and the formula used for the purpose of calculating estimated borrowing power is based on the assumption that interest rates remain constant for the chosen loan term. Your borrowing power amount will be different if a full application is submitted and we complete responsible lending assessment. The results in the calculator do not take into account loan setup or establishment fees nor government, statutory or lenders fees, which may be applicable from time to time. Calculator by Widgetworks.

Pepper Money Personal Loans is a brand of Pepper Money Limited. Credit is provided by Now Finance Group Pty Ltd, Australian Credit Licence Number 425142 as agent for NF Finco 2 Pty Limited ACN 164 213 030. Personal information for Pepper Money Personal Loans is collected, used and disclosed in accordance with Pepper’s Privacy Policy & the credit provider’s Privacy Policy.

Pepper Money Limited ABN 55 094 317 665; AFSL and Australian Credit Licence 286655 (“Pepper”). All rights reserved. Pepper is the servicer of home loans provided by Pepper Finance Corporation Limited ABN 51 094 317 647. Pepper Asset Finance Pty Limited ACN 165 183 317 Australian Credit Licence 458899 is the credit provider for asset finance loans.

Pepper and the Pepper Money logo are registered trademarks of Pepper Group Assets (Australia) Pty Limited and are used under licence.