Offset sub-accounts explained

Estimated read time: 3 Minutes

Maybe you’ve heard about offset sub-accounts but aren’t quite sure how they work? We’re here to make things simple and explain everything you need to know.

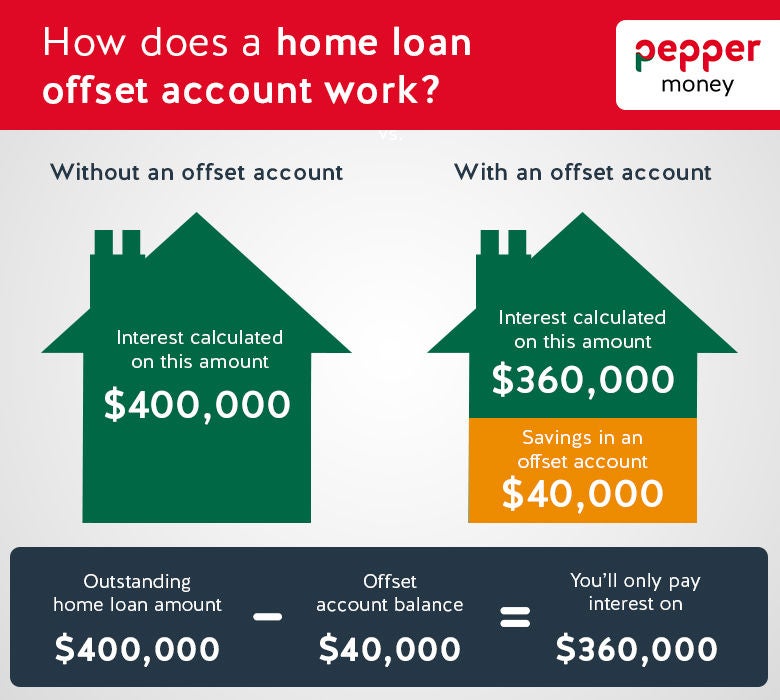

An offset sub-account (also known as an offset account or offset feature) could help you reduce the interest on your home loan, and pay down your home loan faster.

What is an offset sub-account?

How does an offset sub-account work to pay off my loan?

You can have one offset sub-account per home loan, so often people choose to use it like their everyday account. You can have your salary paid directly into the account so that every dollar you have is used to reduce the cost of your home loan. If you have a large lump sum, you can also put this in your offset sub-account if it’s not greater than the balance owing on your home loan.

As your offset sub-account and home loan are linked, if you don’t pay the minimum monthly instalment on your home loan, any money in your offset sub-account may be automatically used to make that payment. This would usually be processed within 14 days after the payment was due, however this timeframe may vary between lenders. If your offset sub-account becomes overdrawn, your lender may also use funds from your other loan account, or accounts, to clear the debit balance.

Visa Debit card feature

With your Pepper Money 100% offset sub-account, you can choose to add a Visa Debit card to easily access your available funds and redraw from your home loan, or even make purchases using Visa payWave®.

You can withdraw up to $1,020 in cash per card and spend up to $5,000 per day, if you have the money in your offset sub-account. Any charges are per account (shared by all card holders) and includes the daily cash limits.

Are there any fees?

There are no fees or charges to access a 100% offset sub-account with Pepper Money, including no monthly fees for any offset sub-account splits.

While we don’t charge a fee for issuing your Visa Debit card, there may be other fees or charges, such as if you lose your card, use it overseas or withdraw money from an ATM. Pepper’s 100% offset sub-account and Visa Debit card are two features that give you more flexibility with your variable rate home loan and may even help you pay off your loan faster.

How could an offset sub-account work for you?

An offset sub-account could be an option to help you reduce the interest on your home loan, and pay down your home loan faster.

Maybe you’ve heard about offset sub-accounts but aren’t quite sure how they work? We’re here to make things simple and explain everything how it could work for your situation.

We’re here to help

Sign up to our newsletter

If you like this article, you'll love our monthly Real Lives newsletter.

View our Privacy Policy